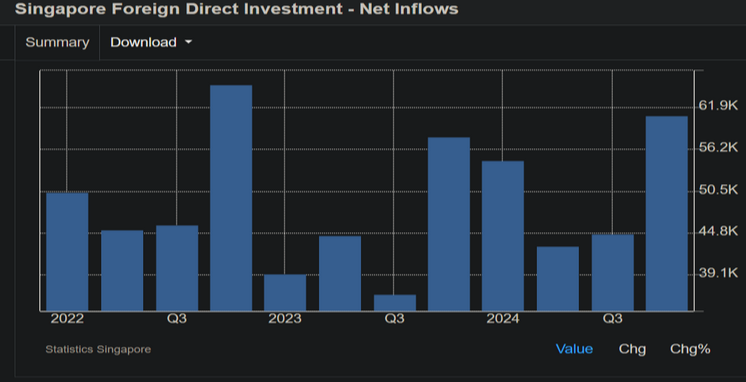

Did you know you can start your dream business in Singapore while visiting on a tourist visa? Yes, you read that right. Singapore’s business-friendly environment, low corporate tax rates, and attractive startup incentives make it a magnet for foreign entrepreneurs. As of 2022, foreign affiliates, companies with over 50% foreign ownership, make up 7.7% of businesses in Singapore, contributing 68.2% of the economy’s value and employing nearly 75% of the workforce. And it’s only getting better. In Q4 2024, Singapore saw a massive FDI inflow of SGD 60.76 billion, proof that the world trusts Singapore’s economic strength.

For Tunisians, the process is even easier. With visa-free entry or an eVisa, you can visit, explore business opportunities, and start your company, all without needing a work visa upfront. Let’s walk through exactly how to make this happen.

Chart: Singapore’s Foreign Direct Investment (FDI) Net Inflows over different quarters from 2022 to 2024

Starting a Business in Singapore as a Tunisian

Tunisians have a great chance to succeed in Singapore’s growing business environment. In recent years, Tunisian-owned businesses have seen steady growth in sectors like real estate, energy, and hospitality. This rise reflects Singapore’s reputation as a global business hub, offering low taxes, strong financial systems, and ideal access to Southeast Asian markets. For Tunisians looking to expand their reach, Singapore provides the perfect platform to succeed.

Here’s the exciting part: you can register a business in Singapore even while visiting on a tourist visa or eVisa. That means you can explore the market, meet potential partners, and set up your company without needing a work visa right away.

Steps to Register a Business in Singapore as a Tunisian

Tunisian entrepreneurs must take a few crucial steps to establish a business in Singapore. This section provides crucial information about business registration, including how to register, requirements for Tunisian, and the application process.

Step 1: Choose a Business Structure

When starting a business in Singapore, entrepreneurs must choose the right business structure. It impacts your liability, ability to attract investors, and potential for growth in Singapore’s dynamic market. Making the right choice will lay a solid foundation for your business success. Here are the options.

The Private Limited Company (Pte Ltd) is the most popular choice for Tunisian entrepreneurs looking to establish a strong presence in Singapore. It offers limited liability, protecting your personal assets from business debts or legal issues. Its scalability makes it easier to attract investors and raise capital, fueling business growth. A Pte Ltd also boosts credibility with clients and banks, helping secure contracts and financing.

A Partnership allows two or more people to share ownership and responsibility for a business. It’s ideal for collaborative deals since partners share decision-making and management duties. However, one major drawback is joint liability; all partners are personally responsible for business debts, which can put personal assets at risk. While partnerships offer flexibility in management, balancing responsibilities and decisions among partners can be challenging.

A Limited Liability Partnership (LLP) combines the flexibility of a partnership with the liability protection of a private limited company. Like a Pte Ltd, an LLP protects your personal assets from business debts, so you won’t be personally liable if things go south. Also, unlike a Pte Ltd, an LLP doesn’t require a formal board of directors, giving partners more freedom to manage the business as they see fit. This makes it a smart choice for small or family-run businesses looking to balance flexibility and security.

Step 2: Reserve a Business Name with ACRA

Now it’s time to give your business a name, and yes, it’s almost as personal as naming your baby. Here, you’ll need to reserve your business name through the Accounting and Corporate Regulatory Authority (ACRA) using the online BizFile+ system. The process is quick and straightforward. Most approvals come through within 1 to 3 days. Your chosen name should be unique and free from restricted terms like “bank” or “government.”

To avoid delays, have a few backup names ready in case your first choice isn’t available. A memorable, catchy name can give your business an edge, so take your time and choose wisely, after all, this is the name your future clients and partners will remember.

Step 3: Appoint a Local Director

To incorporate a company in Singapore, foreign entrepreneurs can easily do so online through the BizFile+ portal using their SingPass account. If any Tunisian wants to manage a business in Singapore by himself, they can apply for an Employment Pass through the newly incorporated company.

However, there’s an important legal requirement to note. Every company in Singapore must have at least one local director who is a Singapore citizen, permanent resident or holds an EntrePass. Don’t worry about finding a local partner; many firms offer nominee director services and appoint a local director to meet the legal requirements. You’ll still retain full control of your business, with the local director ensuring compliance with Singapore’s laws.

Step 4: Register Your Company with ACRA

After securing your business name and appointing a local director, it’s time to officially register your company through the Accounting and Corporate Regulatory Authority (ACRA) using the BizFile+ portal again. This process is entirely online and easy to complete. You’ll need to have a copy of your passport, proof of address, and your company constitution, which is readily available as a template online.

And, the best part? Once all your documents are in order, then the registration process takes just 1 to 2 days. That’s faster than applying for a visa to many other countries, giving you a quick head start to set up your business.

Opening a Corporate Bank Account

With your company officially registered, it’s time to open a business bank account. Singapore’s major banks, including DBS, OCBC, and UOB, are all foreigner-friendly and offer various services to help your business grow. The initial deposit required for opening a corporate account can range from S$0 to S$3,000, depending on the bank and the type of account you choose. This isn’t solely dependent on the bank you approach but also on your business requirements.

You’ll need to provide company registration details, proof of identity for the director(s), and a basic business plan. Some banks let non-residents set up their accounts online, so you can start the process before leaving Singapore. The excitement of logging into your new business account is a thrilling moment that signals a major step toward financial independence and business success.

Apply for the Right Visa to Operate Your Business

While you can register a business in Singapore on a tourist visa, you can’t legally work until you secure the right work visa. Fortunately, Singapore offers two great options for entrepreneurs.

The EntrePass is perfect for startups backed by investors. It requires you to demonstrate an innovative business idea and secure initial funding, usually between S$50,000 – S$100,000. For a higher success rate, it’s recommended that your company has at least S$50,000 in paid-up capital and meets other criteria set by the Ministry of Manpower (MOM).

On the other hand, the Employment Pass (EP) is suited for entrepreneurs who plan to work as the director of their company. To qualify, you’ll need to meet a minimum monthly salary of S$4,500 and have relevant qualifications. Securing either of these visas is a crucial step for long-term business success in Singapore.

Why Singapore is Ideal for Tunisian Entrepreneurs

Tunisia’s growing economy, driven by agriculture, mining, manufacturing, and tourism, presents exciting opportunities for expansion. Tunisian entrepreneurs are already finding success in Singapore’s business-friendly environment, particularly in sectors like trade, technology, and finance. This growing presence strengthens economic ties between the two countries, opening doors for more cross-border investments and collaboration.

Singapore’s low corporate tax rate and strong banking system make it easier for Tunisian businesses to scale and manage international transactions. As more Tunisian companies establish themselves in Singapore, they not only benefit from Southeast Asia’s developing market but also create new opportunities for trade and innovation.

This partnership fosters economic growth on both sides, enhancing Tunisia’s global reach while reinforcing Singapore’s position as a strategic business core.

Tips for Overcoming Challenges

Local Director Requirement: Every company needs at least one local director (citizen, PR, or EntrePass holder). Use a nominee director service to meet this rule without losing control.

Bank Account Approval: Prepare a strong supporting document like company details, business plans, and identity proof for smooth bank account approval.

Visa Approval: Ensure your company meets salary and investment requirements (at least S$50,000 paid-up capital) for better visa approval chances.

Tourist Visa Limitations: You can register a business on a tourist visa, but you can’t work until you get a proper work visa. Focus on registration, bank setup, and office space first.

Conclusion

Starting a business in Singapore while on a tourist visa is not only possible, but it’s also a strategic move for Tunisian entrepreneurs. With Singapore’s business-friendly environment, low taxes, and robust financial system, the country offers a perfect platform to grow and profit. You can register your business, explore opportunities, and set the foundation before securing a work visa.

With the freedom to grow and connect to a global market, Singapore is the perfect place for entrepreneurs to bring their ideas to life and start making a profit. Many Tunisians have already done it; now it’s your turn. Start your business easily and avoid the hassle. Apply for your Singapore eVisa today and let the experts take care of the process so you can launch your business smoothly.